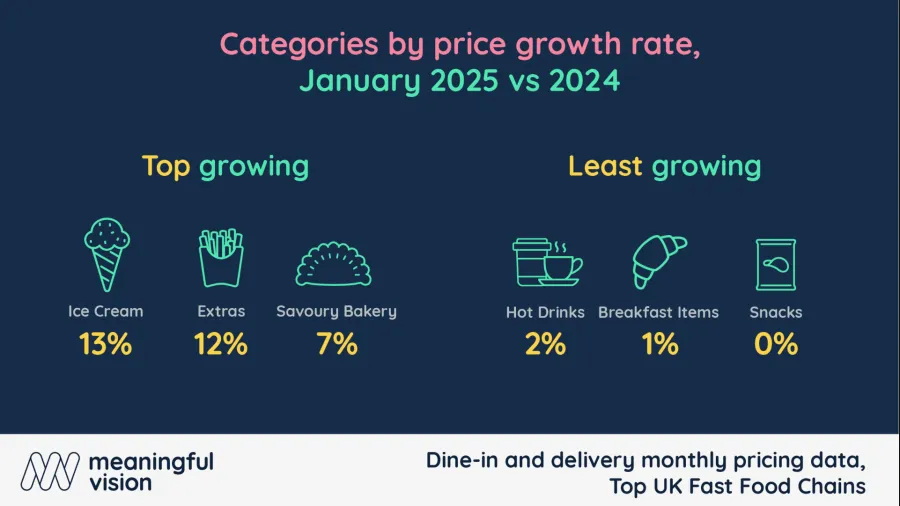

Ice cream prices leap 13% in January

Uneven menu inflation challenges QSRs as some categories rise faster than others.

Ice cream has emerged as one of the most affected categories in the UK foodservice industry, with prices surging by 13% in January 2025, highlighting pressures faced by operators to manage costs without alienating price-sensitive customers.

The surge is part of a wider trend of asymmetric inflation across foodservice menus, as shown by Meaningful Vision Price Intelligence data. The figures reveal sharp increases in categories like extras (12%) and savoury bakery items (7%), whilst others, such as hot drinks (2%), breakfast items (1%), and snacks (0%), have seen minimal movement.

For quick-service restaurants, pinpointing where cost pressures are most acute is essential for refining pricing strategies, protecting margins, and maintaining customer loyalty in a tightening economy, Maria Vanifatova, CEO of Meaningful Vision, said.

“Passing the full cost burden onto consumers risks driving them towards more affordable at-home alternatives, particularly as household budgets are already stretched and even fast-food traffic growth has stagnated,” Vanifatova said.

Vanifatova added that identifying the categories most affected by inflation and understanding the underlying cost drivers will be key for operators looking to stay competitive, profitable, and aligned with shifting consumer behaviour.