Meaningful Vision

Meaningful Vision is a platform that tracks restaurants providing detailed and timely insights into a menu, location, pricing, footfall traffic, and all the ingredients of marketing mix strategies.

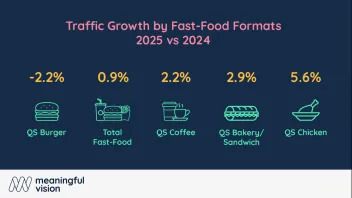

QSR expansion is driving down customer visits

QSR expansion is driving down customer visits

Visits are not keeping pace with restaurant openings.

1 day ago

Why chicken leads the UK QSR market

Visits to chicken restaurants increased significantly, compared to the wider fast-food sector.

Fast-food rises as restaurant visits drop 6.8% in 2025

Expansion of outlets drove fast-food growth.

Fast-food expansion masks 1% visit drop

Northern Ireland led regional outlet growth for the sector in 2025.

UK QSR chains shift focus to value as costs rise

Expansion in 2026 is continuing, but more cautiously.

TGI Fridays’ relaunch falters amidst casual dining slump

Falling footfall, rising costs, and a delayed revamp hurt the brand.

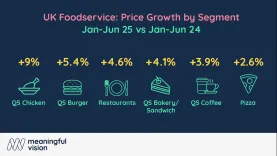

Price spread between fast-food and coffee chains exceeds 100%

Core items such as cappuccino and latte prices rose by about 9%, whilst speciality drinks have surged even more sharply.

Dublin’s fast-food density thins out amidst 7% annual fall in October

This marks the sharpest drop in three years.

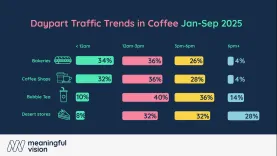

Afternoons now drives coffee traffic

Mid-afternoon to early evenings have become the fastest-growing daypart for coffee shops and bakeries.

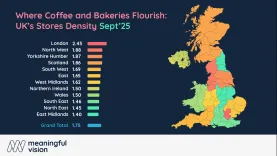

London leads UK’s coffee and bakery boom

In the UK, there are an average of 1.75 outlets for every 10,000 people.

Afternoon crowds shift coffee rush hour

The morning rush is now replaced with a more social coffee occasion.

Restaurant expansion slows despite new players entering the UK

Fast-food chains grew by 2%, according to recent data.

UK foodservice faces sharp price increases in 2025

Chicken chains have increased prices the most.

Domino’s, rivals flock to chicken as competition heats up

Its popularity is driving menu innovation even at non-chicken chains.

Fast-food brands lose growth momentum

London footfall also weakened for the first time since the pandemic.

Loyalty is no longer a ‘nice to have’—analyst

93% of promotions in Q1 were made through mobile apps.

UK QSRs meal deal prices outpace individual menu items' growth in Q1

However, this price promotion, along with LTOs, continues to grow.