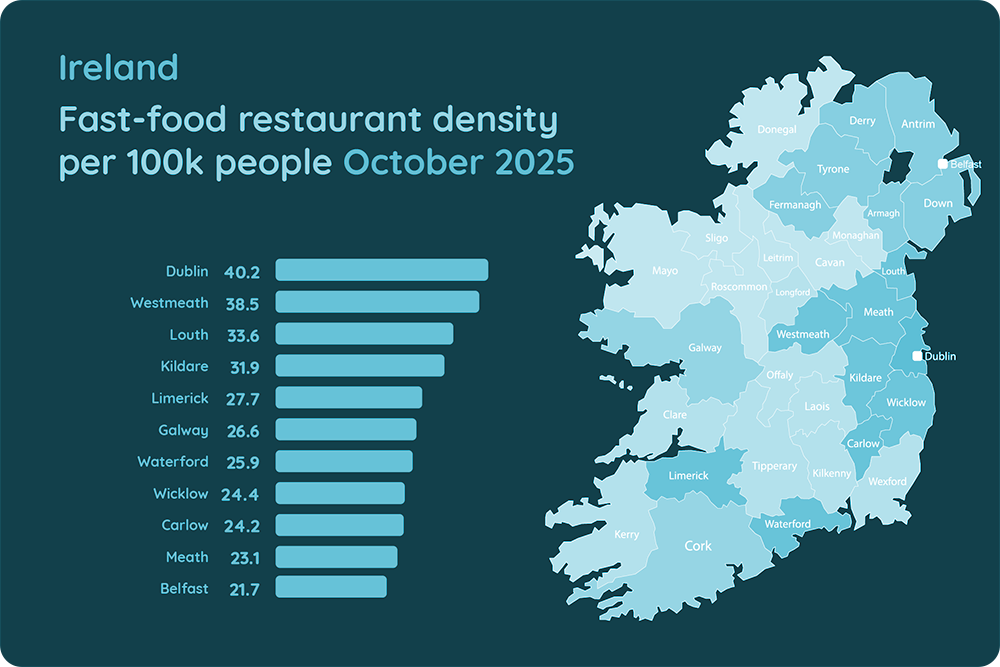

Dublin’s fast-food density thins out amidst 7% annual fall in October

This marks the sharpest drop in three years.

Dublin’s fast-food scene is showing strain, with new figures from Meaningful Vision indicating the number of outlets in the capital fell 7% over the past year—the sharpest drop in three years.

With 40 fast-food sites per 100,000 people, compared with London’s 34, Dublin is now crowded, highly competitive, and offering little room for further growth.

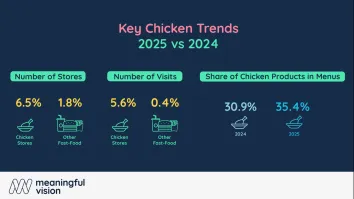

In contrast, regional Ireland is picking up pace. The Northern and Western regions recorded a 3% rise in outlets in the first half of 2025, helped by new burger, coffee, and chicken chains.

Northern Ireland led the upswing with an 18% jump in store numbers, fuelled by fresh entrants to the market.

Counties such as Cork, Galway, and Louth are also driving expansion. Cork’s outlet count rose 1% as coffee and burger chains moved deeper into the suburbs.

Galway is seeing similar momentum, with cafés benefiting from hybrid working patterns and steady daytime demand.

Nationally, Ireland averages 28 fast-food outlets per 100,000 people, but the spread is uneven.

Dublin, Westmeath, Louth, and Kildare sit well above that line, reflecting the pull of commuter zones.

Wexford, Clare, Cavan, and Roscommon fall well below it, pointing to sizeable gaps in the market.

Segment performance also shows widening gaps. Quick-service bakeries and sandwich shops fell 7% after closures at chains like Thunders Home Bakery and O’Briens.

Ethnic outlets dropped 12%, underlining the difficulty smaller operators face amid rising costs and shifting eating habits.

“Whilst total chained fast-food outlets in Ireland declined 3% in H1 2025, this national figure masks an important divide: contraction in Dublin versus measured growth across regional markets,” said Maria Vanifatova, CEO of Meaningful Vision.

She points to recent openings—including Taco Bell in Meath in September 2025 and Wendy’s in Cork a month later—as signs that operators are increasingly targeting counties where competition is lighter.

“Competition is intensifying as new international brands enter Ireland, raising the stakes for mature operators. Dublin is no longer the centre of gravity,” Vanifatova said.

“Regional markets, from Cork to Northern Ireland, are now the real opportunity zones. Success will belong to brands that combine insight-led location strategy with agile, data-driven expansion,” she added.