Loyalty is no longer a ‘nice to have’—analyst

93% of promotions in Q1 were made through mobile apps.

UK fast-food chains are increasingly relying on promotions and loyalty programs to defend market share as consumers cut back amidst economic uncertainty, an analyst said.

In the UK’s highly competitive fast-food and casual dining markets, with today’s background of relative economic uncertainty, businesses are challenged to hit targets, maintain margins and sustain traffic.

With demand lagging behind rising costs, consumers appear increasingly price-conscious and show a willingness to switch brands for better value.

“In this climate, promotions and loyalty programs are no longer optional "nice-to-haves" but have become essential tools for success, helping brands to retain and grow their customer base, defend their market share, and build relationships,” Maria Vanifatova, CEO of Meaningful Vision, said.

Vanifatova pointed out that promotions are becoming smarter, sharper, and more digital.

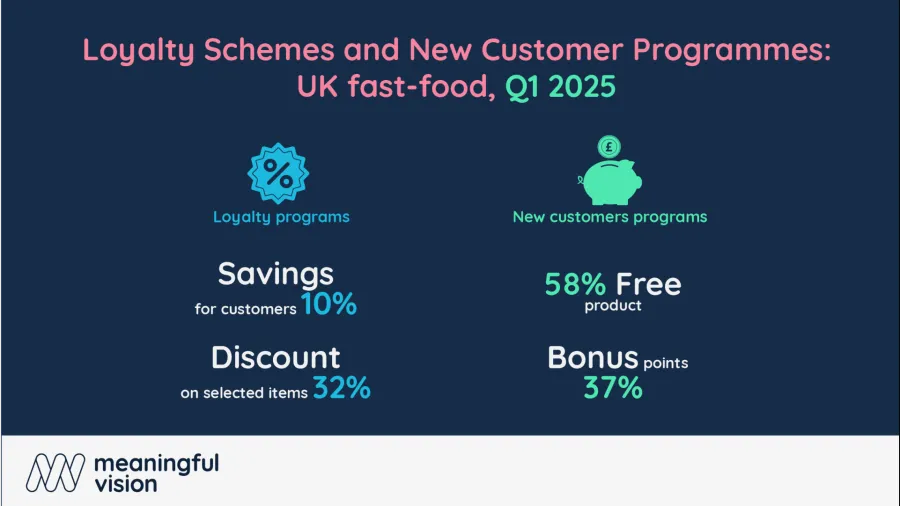

Mobile apps are now a key promotional battleground, with 93% of promotions running through apps in Q1 2025. The average discount on selected items in apps is 32%, a figure significantly higher than on delivery platforms, demonstrating a commitment from brands to go further to attract and keep digital users.

Brands are also focusing on enticements for high-value customers rather than offers for bargain hunters. Other promotional tools include meal deals and Limited Time Offers (LTOs).

In Q1 2025, the share of meal deals in fast food grew from 15% to 17%. LTOs, employed to generate a sense of urgency to attract customers, make up about 5% of a typical menu, with burgers, coffee, and sandwiches having the highest share.

Loyalty programs have also become a competitive necessity. Three-quarters of fast-food chains in the UK now have a loyalty program, and nearly all of them are app-based.

“These programs are moving beyond simple models like "10th cup free" to more sophisticated systems that use gamification, such as interactive challenges, spin-to-win wheels, and unlockable tiers,” Vanifatova said.

She added that this makes rewards a fun and engaging experience rather than just a transaction. Customers who join a loyalty program receive a 10% reward on a typical spend of £24.

For brands, the benefits are even greater, including higher visit frequency, better data, and stronger emotional connections with customers.

Loyalty programs are also being used as a tool for customer acquisition, with 52% of them now offering incentives to new customers. The most common incentives for new fast-food customers are a free product (58%) or bonus points (37%).

"Promotions and loyalty are no longer just about driving short-term sales. They’re about owning the customer relationship. Those who use data cleverly to craft relevant, rewarding experiences will win both share and loyalty,” Vanifatova said.