Bakery chains thrive as burger segment declines in the UK

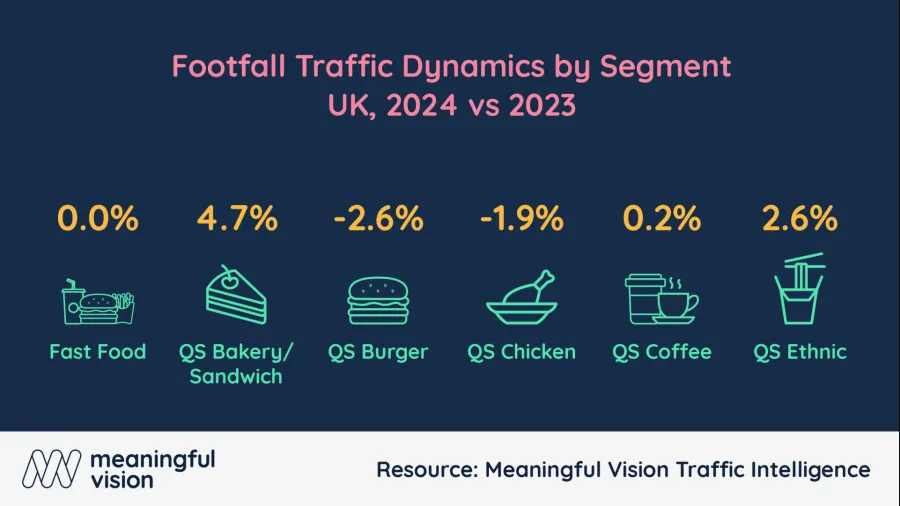

Bakery chain traffic went up 4.7% whilst burger joints declined 2.6%

Bakeries and sandwich shops emerged as the clear winners in the UK’s fast-food market, experiencing a 4.7% surge in traffic in 2024, a report by Meaningful Vision said.

This growth was fuelled primarily by the rapid expansion of popular chains like Greggs, Gail's, and Pret A Manger, catering to the demand for convenient and affordable options.

However, like-for-like traffic growth within this segment was a more moderate 2%.

Ethnic fast-food also enjoyed a successful year, with a 2.6% increase in traffic.

Brands such as Chopstix, Itsu, and German Doner Kebab were key drivers of this growth, reflecting a growing consumer appetite for diverse culinary experiences. Coffee shops demonstrated stable performance, but experienced slower growth at 0.2%, largely due to fewer new store openings.

By contrast, the burger segment faced significant challenges with a 2.6% decline in traffic, indicating established burger chains are facing increased competition from other fast-food categories.

Results in the chicken segment were more impressive and whilst overall traffic decreased by 1.9%, a notable recovery of 1.1% growth in the fourth quarter offered a positive sign. These encouraging signals may be explained by the arrival and expansion of new American chicken chains, reigniting consumer interest.

Adapting to a changing market

Highlighting the dynamic nature of the UK fast-food market, Meaningful Vision said the performance of operators in the industry through 2024 demonstrates the need for careful planning and insightful decision-making by marketing teams.

Whilst some segments thrived and even expanded, employing successful strategies with respect to evolving preferences among consumers, others struggled with increased competition and changes in the typical dining habits of their customers.

Moving into 2025, brands across all segments will need to adapt to prevailing trends to remain competitive.

“The UK fast-food market will remain highly competitive in 2025. While burger chains still hold a significant market share, they face increasing pressure from other categories, especially chicken and ethnic fast-food. Ultimately, the winners in 2025 will be those operators who can effectively leverage data-driven insights into consumer behaviour, daypart dynamics, and segment trends. Menu innovation, strategic pricing, and targeted Foodservice Promotion will play an important role in sustaining interest and driving sales,” Maria Vanifatova, CEO of Meaningful Vision said.