How consumer trends and tech are shaping Singapore’s foodservice

F&B business closures rose by 19.7% in the last nine months.

Though the foodservice sector is facing a difficult year with restaurant groups reporting losses and F&B businesses closing, key trends in consumer behaviour and technology will drive its future for better or for worse, an analyst said.

In a report by KnightFrank 2,465 F&B businesses closed in the last nine months, an increase of 19.7% compared to 2023. The property group said many homegrown F&B operators are forced to innovate and/or consolidate to keep business operations at sustainable levels in what is a very Darwinian retail environment

Tim Hill, Key Accounts Director at GlobalData, said one key trend that he has noticed over the year is how technology technology has played a significant role in transforming the local foodservice industry, with innovations such as automation and digital ordering systems gaining traction. He noted chains like Haidilao Hotpot, known for its use of smart automation, have already seen positive results, such as cost savings and increased efficiency. In addition, the rise of robots, such as Ella, the robot barista, is helping to redefine the dining experience in Singapore.

The widespread adoption of QR code ordering and mobile payment systems, accelerated by the pandemic, has also reshaped how consumers interact with restaurants. A recent GlobalData survey revealed that 36% of Singaporeans regularly use QR codes to order food, a trend particularly prevalent among Gen Z consumers. The convenience of ordering and paying via smartphones has led many younger diners to prefer this method over traditional waiter service.

Social media influencers

Hill also said that social media has become an influential factor in consumer decision-making, with nearly half of Singaporeans (48%) indicating that recommendations from influencers are important when choosing where to eat. This trend is even stronger among Singaporean Gen Z males, where 76% find social media input essential or helpful in their dining choices.

As food-related content dominates platforms like Instagram and TikTok, the impact of influencers on the foodservice industry in Singapore is likely to continue growing. Restaurants that leverage influencer marketing and online recommendations may see increased customer engagement and brand awareness.

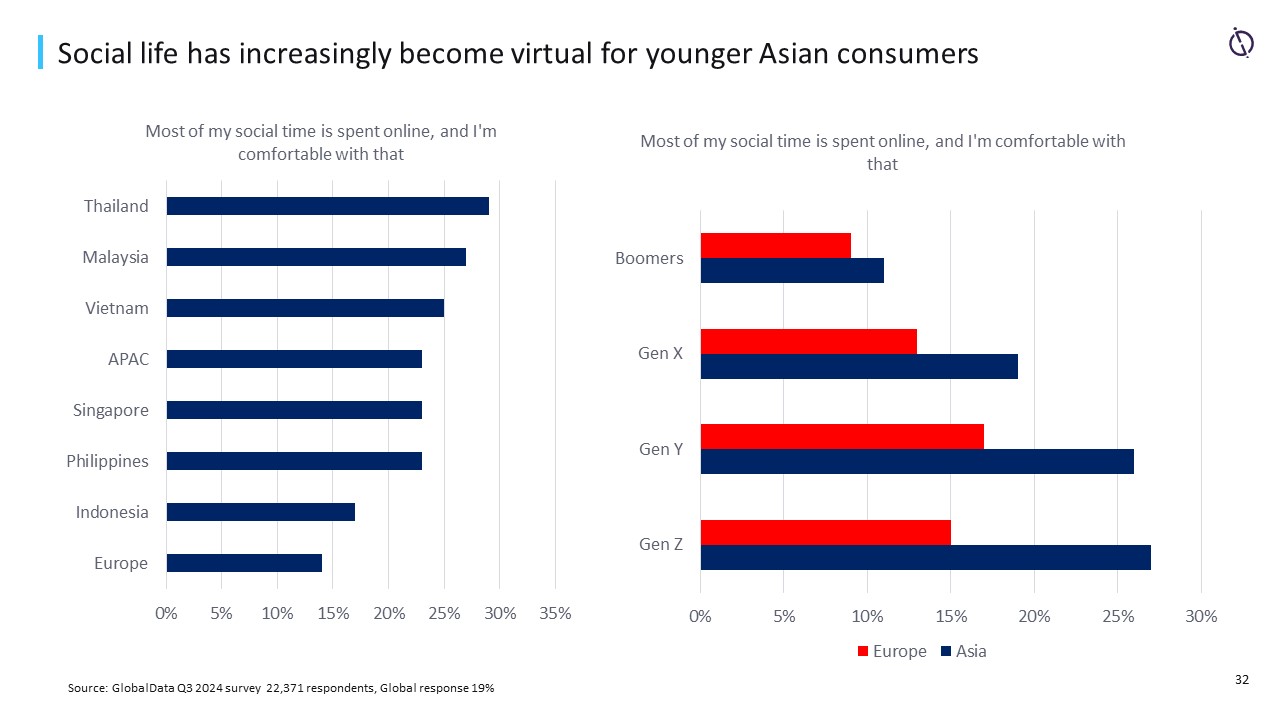

Meanwhile, Hill also noted that younger consumers are also shifting their social habits. Many Gen Z and younger Singaporeans are increasingly prioritising virtual social interactions over face-to-face gatherings. According to Hill 23% of Singaporeans now spend most of their social time online, a trend that is more pronounced amongst younger age groups.

“Singapore’s foodservice sector is largely optimistic. Indeed, the upturn in both business and leisure travel in the region is one factor beyond local consumption trends that can propel growth. Our forecast for the three-year compound annual growth rates to 2028 is 4% for restaurants, 4.2% for pubs and bars, 4.8% for fast food and 5.6% for coffee and tea shops,” Hill said.