McDonald’s visits dip as emerging chains grow, analyst says

However, the fast-food giant’s share remains stable at 42%.

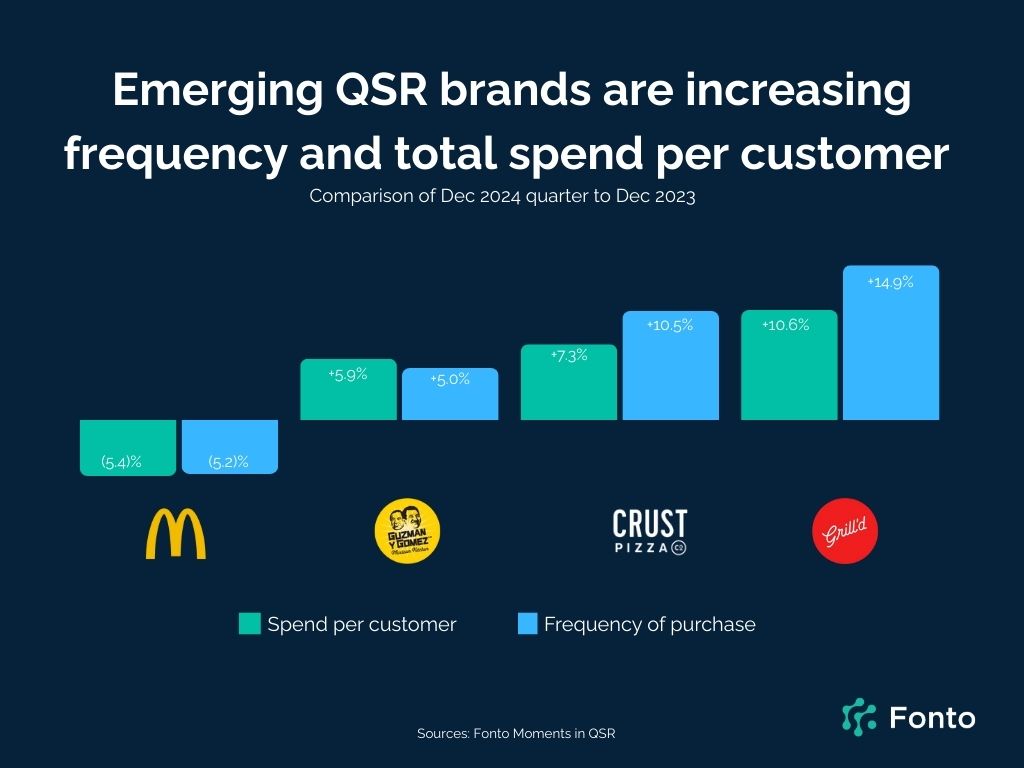

McDonald’s saw a 5% dip in customer frequency, whilst emerging quick-service restaurant brands saw an increase in foot traffic during the December 2024 quarter compared to the same period last year, according to the Moments in QSR report by Fonto.

Macca’s market share remained stable for the period at 42%, however, the report said that customers spent 5.4% less on average compared to the year prior.

Meanwhile, Grill’d saw an increase in the frequency of purchase by 14.9%, with average spending per customer lifting by 10.6% when compared to the December 2023 period.

Crust Pizza, although a smaller player with just a 3% market share, managed to increase its frequency of purchase by 10.5% and spend per customer by 7.3%. Guzman Y Gomez, which recently announced a 27% increase in revenue, lifted customer frequency of purchase by 5% and spend per customer by almost 6%. Market share accordingly lifted from 3.0 to 4.2%.

The report acknowledges that the average basket size for Crust and Grill’d dropped slightly, but Fonto said the gains per customer more than outweighed the loss in individual transaction size.

“We are seeing customers embracing alternatives, especially ones that promote fresher ingredients, even in the fast food space. Where Domino’s has recently faced challenges in product quality, Crust continues to bring customers back, spending more. Where consumers are looking for fresher, higher quality burger alternative, Grill’d is taking share and loyalty away from the larger chains. GyG’s overall brand promise as healthier fast food is also clearly working, with their sales and profit up across the board,” Ben Dixon, CEO of Fonto, said.