The rise of value hackers in SEA and how it affects QSRs

This trend can potentially impact menu innovation in restaurants.

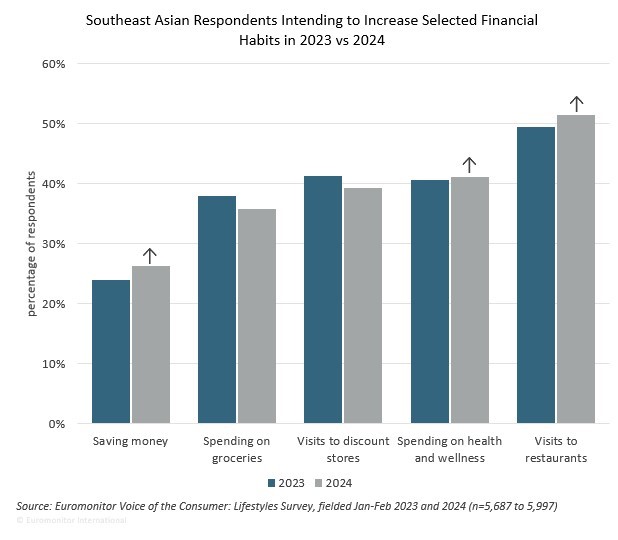

Balancing the desire to save money with the temptation to indulge is a common dilemma, especially amongst the emerging group of consumers known as value hackers.

Emil Fazira, Food Insight Manager in Asia at Euromonitor International, describes value hackers as consumers who want to outsmart the system when it comes to getting the best deals and discounts.

“They are not about short-term savings but getting the most out of it for the long term that suits their financial habits which is a mix between trying to reward themselves and having money-saving habits,” Emil said.

This means that these types of consumers do not just look at price when eating out, but the long-term benefits to them and what these businesses can offer them in the long run.

Competitive innovation

According to Euromonitor’s data, SEA consumers look for two things the most when purchasing food and beverage products. One is its health and nutrition benefits (51%) and the second is low prices (43%)

These data tell us that QSRs should focus on offering products that are both healthy and affordable. This could involve creating new menu items or adjusting existing ones to meet these criteria and promoting these features prominently.

“There needs to be an affordable range but many of them also want to give more value to differentiate from the competitor. So they have another range of products. For instance, some chains have a signature menu or a more premium one,” Emil said.

One example is the recent launch of KFC Singapore’s ETC Burger. The brand spent SG$1m to upgrade its burger-making capabilities. The new burger itself is made from more premium ingredients. The cost of the ETC Burger is around SG$7.45.

Emil also said seasonal offerings and limited edition menus are also affected as these types of products generally generate more excitement.

“Having these types of menus can attract people who don’t usually go to QSRs but they might and try the item. From this group of consumers who rarely come, when they do come, they will spend higher,” Emil said.

Loyalty programmes

With the rise of the new value savers, will there the use of loyalty programmes in Southeast Asia advance?

Emil said currently, only the big chains like McDonald’s have made progress in making the use of their loyalty programmes commonplace.

“One of the reasons behind that is that the strength of superapps in Southeast Asia is very strong. You have your Grab, your foodpanda, and you have other local players. Because consumers in SEA like that their choices are all in one location. So in this case, partnerships are really important,” Emil said.

What these superapps are doing to maintain their hold in the market is partnering with QSR brands and launching discount programmes. Aside from bundle delivery deals, dining in the restaurant is encouraged by giving consumers choices to do self-pickups or advance order.

“It also gives people the idea that oh, this app is useful for me not just for delivery, they can give me discounts for other purposes as well. It is covering more consumption occasions. And this is where the competition is getting more aggressive,” Emil said.

Changing the game

Emil said this trend is changing competition in the industry in many ways.

First is how brands approach loyalty.

“Because there are so many ways you could approach loyalty either through partnerships, embedded finance, or with the operators themselves or even with the ingredients,” Emil said.

Emil also foresees pricing will become more dynamic, not just at a point in time but as a way for brands to offer the most value to consumers in the long run.

“You’ve heard of virtual kitchens? That creates opportunities for value. Instead of going to a restaurant where I can only buy from that specific menu, it is more valuable for a consumer to order in a restaurant that also has a virtual kitchen.”